Skills Development Services for Industry-Specific Vocational Training

Business Model Description

Provide vocational and technical skills development services to companies in order to upgrade skills and foster the acquirement of new skills aligned with the key industries' needs and requirements, especially for healthcare, tourism, ICT, agriculture and finance. Offer subscription-based trainings or direct training delivery, building partnership with existing organizations and corporates.

Expected Impact

Up- and re-skill the national workforce to meet the needs of key industries and increase Mauritius' workforce and industry competitiveness.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

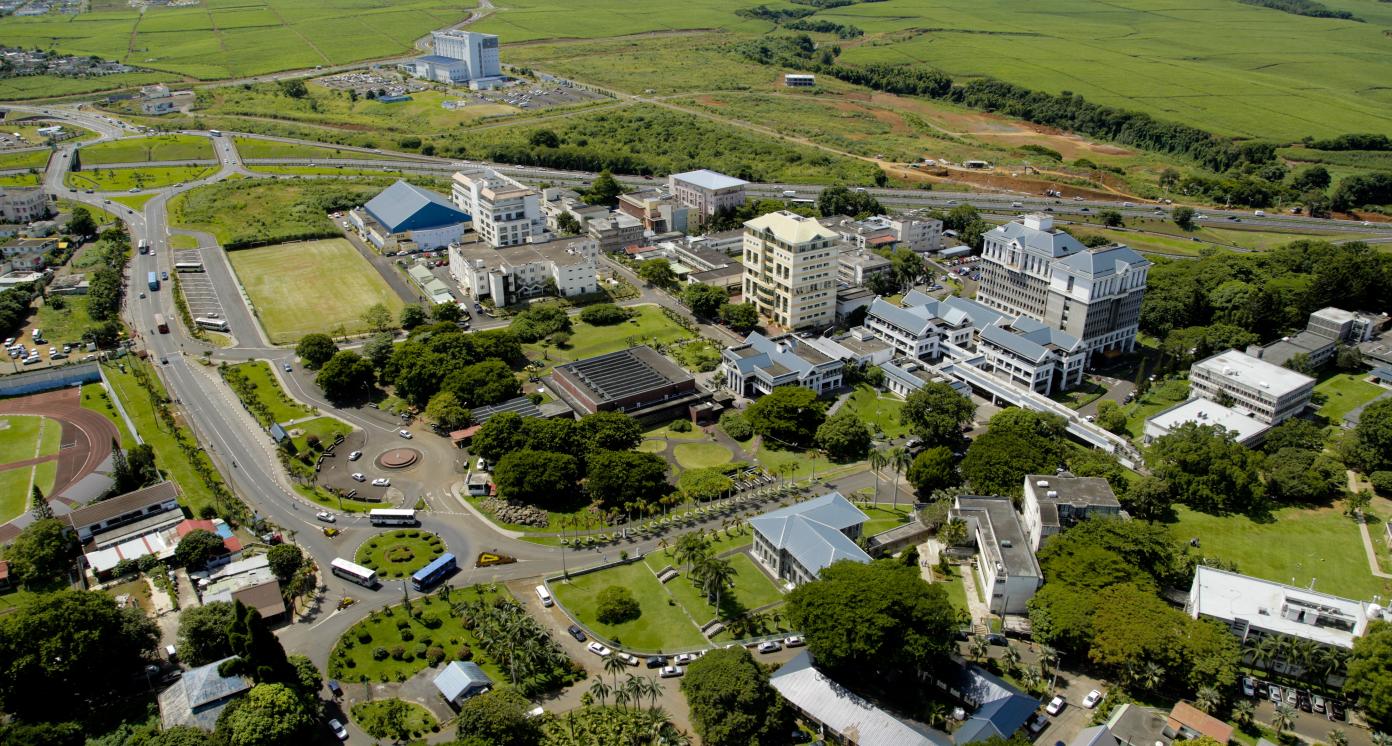

- Mauritius: Countrywide

- Mauritius: Moka

- Mauritius: Rodrigues

- Mauritius: Plaines Wilhems

Sector Classification

Education

Development need

Over the years, Mauritius is characterized by the problem of education and skills mismatch leading to a disconnect between the needs of the economy and the education system. The resulting consequences in the form of labor shortages and underemployment of educated workers are further aggravated by an aging population (1). In 2020, youth unemployment was of 26.1% (16).

Policy priority

Government Programme for 2020-2024 includes the aim to position Mauritius as the leading education hub for the region (2). The Higher Education Commission Strategic Plan emphasizes learning through modern digital technology and latest best practices and rendering Mauritius a regional knowledge hub (15).

Gender inequalities and marginalization issues

Though Mauritius performs exceptionally well in terms of gender equality within education, it still experiences a lack of women with STEM-related degrees (Science, Technology, Engineering and Mathematics). This results in gender unequal payment given that STEM related careers are highly valued (3).

Investment opportunities introduction

Various incentives ranging from 3% corporate tax; exemption of tax on IT and IT related materials and equipment for setting up of private campuses as well as grant-in-aid for running Special Education Needs Schools exist. The budget allocation for upgrading and establishment of school infrastructure as well as to support online learning also increased (4).

Key bottlenecks introduction

In spite of educational reforms and significant government investment in the education sector, the education-skill mismatch still persists. There is a need to develop projects that generate interest in skills demanded by the market and emerging sectors (5).

Formal Education

Development need

With a limited natural resources capital, Mauritius needs to develop higher skills, professional capacity and advanced knowledge in order to achieve its goal of a higher income country and a knowledge-based economy (the objective is that knowledge contributes to 10% of GDP by 2025) (6, 17, 15, 25). It also needs to upgrade the quality of its tertiary and higher education (25).

Policy priority

The National Training and Reskilling Scheme aims at reskilling 9,000 unemployed in key sectors of the economy (7). The Government also launched the “One Graduate per Family” policy, aiming at increasing the skills and competence of young people (25). Mauritius also aims at becoming a regional education hub (17), improve enrolment in STEM education and ICTs literacy (37, 38).

Gender inequalities and marginalization issues

Women and youth face lower initial earnings and more difficulty in catching up with high-paid workers, partly due to their lack of skills to access job opportunities in expanding and highly paid sectors (8). Additionally, a strong gendered pattern appears in the STEM education at secondary, tertiary and doctoral levels (36).

Investment opportunities introduction

The Human Resource Development Council contributes to employees' training costs of up to MUR 60,000 (USD 2,000) per employee in training (9, 35). Opportunities are in formal education development in the sectors of agriculture, ICTs, tourism and STEM thanks to favorable investment conditions for international private universities and students (6, 37, 21).

Key bottlenecks introduction

Enrolment is high in low-demand fields, when it is rather low in high-demand fields such as STEM or specialized manual activities. Additionally, the curricula often do not respond to the demand of the labor market for soft skills, especially for academic and technical levels (6).

Pipeline Opportunity

Skills Development Services for Industry-Specific Vocational Training

Provide vocational and technical skills development services to companies in order to upgrade skills and foster the acquirement of new skills aligned with the key industries' needs and requirements, especially for healthcare, tourism, ICT, agriculture and finance. Offer subscription-based trainings or direct training delivery, building partnership with existing organizations and corporates.

Business Case

Market Size and Environment

USD 50 million - USD 100 million

From 2003 to 2019, Mauritius' National Training Fund disbursed MUR 3.7 billion (USD 83 million) as training incentives to employees (27).

In the government's 2018-2019 budget, MUR 10 million (USD 230,000) were allocated for training under the Graduate Training for Employment Scheme (GTES) (27).

The proportion of firms investing in training increases with firm size and according to sector. In ICT sector, propensity to train was 7.4% for small companies (firms with 1-9 employees) and as high as 46.7% in large companies (firms with more than 50 employees) (48).

Indicative Return

> 25%

ECCS Africa provides IT trainings to businesses in Mauritius and recorded a gross profit margin of 49% in 2020 (18).

Investment Timeframe

Short Term (0–5 years)

Stakeholder interview with a prominent professional skills qualification provider revealed that investments in skill development centers can generate positive return in one to two years provided that a viable business model, such as a partnership with existing companies, is established (47).

Ticket Size

USD 500,000 - USD 1 million

Market Risks & Scale Obstacles

Capital - Limited Investor Interest

Low Marketability

Impact Case

Sustainable Development Need

Labor force skills mismatch hampered economic growth and productivity, increasing the unemployment rate to 9.2% in 2020 (16) Structural unemployment level is expected to persist as the country transitions towards the services sector (68.19% of GDP) requiring more skill intensive activities (22, 40)

TVET institutions are mainly attended by those who have underperformed in secondary schools, while bachelor degree graduates fail to be absorbed by the industry (39). Due to limited labor market, Mauritius imports labor to fill the skills gap, number of foreign workers reaching 30,013 in 2021 (26).

Mauritius has a rapidly aging society with the population above 60 expected to reach 30% by 2045 (40), further limiting the labor market and increasing the dependency ratio.

Gender & Marginalisation

The unemployment rate among the youth is higher than the one of the general population, with a rate of 26.1% in 2020 (16). This reinforces their marginalization in putting at risk their future on the labor market and social inclusion (31).

Female unemployment rate was 11.9%, while male unemployment was 7.8% in 2020 (21). Women face disadvantages in terms of labor market access, with participation remaining at 45.9% in 2019 (23, 31).

Informal jobs and incomes at the bottom end of the income pyramid were particularly impacted by the COVID-19 pandemic (40).

Expected Development Outcome

Skills development services enable upskilling the workforce so as to respond to the dynamics of the labor market and to enable gains in resilience and productivity, resulting and enhanced economic growth (19).

Through close collaboration between academia and the private sector, skills development services tackle the mismatch between knowledge and skill development (20, 8), and satisfy the labor market's demands on employees’ qualifications, which will reduce unemployment (8).

Gender & Marginalisation

Skills development services enable to close national skill gaps and prepare the young population for their working life that enables the long-term employability of youth (1).

Through skills development services, women benefit form more training opportunities supporting their upskilling and employment, as well as increased salaries (8).

Primary SDGs addressed

4.3.1 Participation rate of youth and adults in formal and non-formal education and training in the previous 12 months, by sex

Literacy rate of 98.1% among the 15-24 years in 2019 (17).

Mauritius government targets to reach 68,000 students enrolment in tertiary education by 2025 (25).

8.5.1 Average hourly earnings of employees, by sex, age, occupation and persons with disabilities

8.5.2 Unemployment rate, by sex, age and persons with disabilities

8.6.1 Proportion of youth (aged 15–24 years) not in education, employment or training

Average hourly earnings for male employees is MUR 163.5 (USD 3.80) and for female employees is MUR 143.7 (USD 3.30) in 2019 (24).

Unemployment rate was 9.2% (7.8% male, 11.1% female) in 2020 (24).

The youth aged 16 to 24 years who reported to be neither working nor studying or in training was 15.7% in 2019 (24).

N/A

4% by 2030 (44).

As a member of the African Union (AU), Mauritius aims to reduce youth unemployment by 2% annually until 2023, as indicated in the African Union's Agenda 2063 - First Ten Year Plan (2013-2023) (45).

10.4.1 Labour share of GDP

Labor share of GDP was 39% in 2020 (24).

N/A

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Corporates

Public sector

Indirectly impacted stakeholders

People

Corporates

Public sector

Outcome Risks

Skill development services may aggravate existing issues in access to education, as well as upskilling efforts concerning social and economic disparities.

Impact Risks

The impact of skill development services on labor force employability may be limited if their curriculum is not aligned with the market demands of the private sector (46).

Change in policy environment, including national skills development strategy and regulation, may limit the expected positive impact.

International skill development institutions may surpass national service providers with foreign certifications and qualifications at low costs, limiting the domestic value addition.

Impact Classification

What

Skills development services tackle the skills mismatch between the labor market and educational institutions, increase employability and advance the skills and qualifications of trainees.

Who

New entrants to the labor market, the existing workforce and companies that require an upskilled workforce, especially in healthcare, tourism, ICT, agriculture and finance, benefit from skills development services.

Risk

Local value addition, government's commitment and private sector interest determine the endurance and scale of positive impact brought about by skill development centers.

Contribution

Skills development services increase employability of the Mauritian labor force, alongside tertiary education institutes and online learning platforms.

How Much

The skill development ecosystem contributes to the target of the Mauritius' government of increasing the knowledge sector's contribution to GDP from 2.7% to 10% by 2025 (25).

Impact Thesis

Up- and re-skill the national workforce to meet the needs of key industries and increase Mauritius' workforce and industry competitiveness.

Enabling Environment

Policy Environment

National Skills Development Strategy (NSDS) 2020-2024, 2019: Aims at improving the effectiveness and efficiency of the skills development system in Mauritius, notably by supporting its development in line with governmental priorities (28).

Government Programme 2020-2024, 2020: Targets to continue investing in dual and vocational trainings for youth in non-academic fields (2).

National Training & Reskilling Scheme (NTRS), 2020: Targets reskilling around 9,000 unemployed labourers with six months duration training courses in different fields, including agro-industry, ICT and healthcare (42).

Youth Employment Programme (YEP): Skills Working Group (SWG), a joint public-private initiative, has been established to implement the Youth Employment Programme. The programme offers training for youth in various fields, including agriculture, ICT, human health and social work activities (41).

Financial Environment

Financial incentives: The Skills Development Support Scheme for Foreign Direct Investment incentivizes foreign investors to provide training to their employees, by reimbursing up to 80% of the training cost (29). The Mauritius Training Fund, incentivizes on-the-job training (27).

Fiscal incentives: The construction, and expansion of student campuses will be exempted from land transfer tax and registration duty. A concessional 3% corporate tax rate to private universities in Mauritius will also be provided (21).

Other incentives: The National Skills Development Programme offers training and placement of 3-12 months’ duration for unemployed people having their diploma in areas needed by the labor market. The trainees will be paid a monthly stipend of MUR 6,000 (USD 138) (30).

Regulatory Environment

Skills Development Authority Bill, 2019: Establishes the Skills Development Authority and provides for its functions, including the promotion and enhancing quality of TVET, promote the access to TVET, and establish the criteria for institutions to be awarding (33).

Mauritius Institute of Training and Development Act, 2009: Establishes the Mauritius Institute of Training and Development, which has the function of promoting excellence, research and enhance knowledge in TVET, as well as increasing access to it (34).

Marketplace Participants

Private Sector

Amity Centre of Excellence (Amity Business School), Soft Skill Consultants, Medine Sugar Estates Co Ltd; Vocational Training Institute (VTI).

Government

Ministry of Education, Ministry of Human Resources, Ministry of Labour, Human Resource Development and Training, Human Resource Development Council, Civil Service College Mauritius, Mauritius Institute of Training and Development, Commission for Education and Training (Rodrigues).

Multilaterals

International Labour Organisation (ILO), UNESCO, African Union (AU), African Development Bank (AfDB), World Bank, OECD, German Academic Exchange Service (DAAD).

Non-Profit

Agence Française de Développement (AFD), Société Française d’Exportation des Ressources Educatives (SFERE).

Target Locations

Mauritius: Countrywide

Mauritius: Moka

Mauritius: Rodrigues

Mauritius: Plaines Wilhems

References

- (1) V. Tandrayen. 2020. Addressing the Education and Skills Mismatch in the Mauritian Economy. https://www.researchgate.net/project/Addressing-the-Education-and-Skills-Mismatch-in-the-Mauritian-Economy.

- (2) President of the Republic of Mauritius. 2020. Government Programme 2020-2024, Towards an Inclusive, High-income and Green Mauritius, Forging ahead. https://www.mcci.org/media/230932/govt-programme-2020-2024.pdf.

- (3) The Bjorn Project. September 5, 2018. Girls' Education in Mauritius Improves Day by Day. https://borgenproject.org/girls-education-in-mauritius-improves-day-by-day/.

- (4) Platform Africa. June 4, 2020. Mauritius Budget 2020-21: Finance Minister Padayachy introduces “Our new normal, the economy of life”. https://www.platformafrica.com/2020/06/04/mauritius-budget-2020-21/

- (5) HRDC. 2021. HRDC launches survey to gauge interest of secondary school students in STEM education. https://www.hrdc.mu/index.php/news-press/348-hrdc-launches-survey-to-gauge-interest-of-secondary-school-students-in-stem-education.

- (6) Business Mauritius. 2019. Implementing a National Business Roadmap for a better Mauritius by improving the management of our scarce natural resources, developing our human capital, strengthening our governance and addressing our environmental vulnerabilities. https://www.businessmauritius.org/wp-content/uploads/2021/05/2019-04-19-BM-Budget-Memo_Final.docx.pdf.

- (7) HRDC. 2020. National Training & Reskilling Scheme (NTRS). https://www.hrdc.mu/index.php/news-press/329-economic-recovery-programme-national-training-and-reskilling-scheme-ntrs-1.

- (8) World Bank. 2019. Mauritius: Earnings Mobility and Inequality of Opportunity in the Labor Market. https://documents1.worldbank.org/curated/en/104241556030746321/pdf/Mauritius-Earnings-Mobility-and-Inequality-of-Opportunity-in-the-Labor-Market.pdf.

- (9) HRDC. https://www.hrdc.mu/index.php/ntrs.

- (10) MyJob.mu. Accenture Academy - MSC Scholarship in Applied Software Technologies. https://www.myjob.mu/Jobs/Accenture-Academy-MSc-Scholarship-in-110189.aspx.

- (11) Mauritius Africa Fintech Hub. 2021. Launch of the Future FinTech Champion Programme!. https://mauritiusfintech.org/blog/launch-future-fintech-champion-programme/.

- (12) Le wagon. Data Science course in Mauritius. https://www.lewagon.com/mauritius/data-science-course/full-time.

- (13) Vatel. https://www.vatel.mu/join-vatel-mauritius-today/?gclid=Cj0KCQiA8ICOBhDmARIsAEGI6o2K7QQgC7qjz47GK63h7tCr_RFx2p4T4Lkid7Wdj6rWE0m5UQdqNYQaAj9jEALw_wcB.

- (14) Adecco. 2020. Training Brochure 2020-2021. https://www.proactive.mu/wp-content/uploads/2020/11/adecco-training-brochure.pdf.

- (15) HEC. 2022. Higher Education Commission Strategic Plan 2022-2025, Building a Responsive, Relevant and Resilient Higher Education Sector. https://www.hec.mu/pdf_downloads/StrategicPlan/HEC_Strategic_Plan_2022_2025.pdf.

- (16) Statistic Mauritius. 2021. Labour force, Employment and Unemployment – Year 2020. https://statsmauritius.govmu.org/Documents/Statistics/ESI/2021/EI1583/LF_Emp_Unemp_Yr20_180521.pdf.

- (17) Ministry of Foreign Affairs. 2019. Voluntary National Review Report of Mauritius 2019. https://sustainabledevelopment.un.org/content/documents/23462Mauritius_VNR_Report_2019.pdf.

- (18) Corporate and Business Registration Department (CBRD). 2022. File No C149272. https://companies.govmu.org:4343/MNSOnlineSearch/.

- (19) NPCC. 2021. Strategic Plan 2021-2025, Building a resilient tomorrow. https://www.npccmauritius.org/images/download/246.pdf.

- (20) World Bank. 2015. Systematic Country Diagnosis Mauritius. https://elibrary.worldbank.org/doi/epdf/10.1596/23110

- (21) Republic of Mauritius. 2021. Budget Speech 2021-2022, Better Together. https://budgetmof.govmu.org/Documents/2021_22budgetspeech_english.pdf.

- (22) Statistica. 2021. Mauritius: Share of economic sectors in gross domestic product (GDP) from 2010 to 2020. https://www-statista-com.mutex.gmu.edu/statistics/729048/share-of-economic-sectors-in-gdp-in-mauritius/.

- (23) Trading Economics. Mauritius - Labor Force Participation Rate, Female (% Of Female Population Ages 15+) (national Estimate). https://tradingeconomics.com/mauritius/labor-force-participation-rate-female-percent-of-female-population-ages-15-national-estimate-wb-data.html#:~:text=%2B)%20(national%20Estimate)-,Labor%20force%20participation%20rate%2C%20female%20(%25%20of%20female%20population%20ages,compiled%20from%20officially%20recognized%20sources.

- (24) Statistic Mauritius. UN_SDG_Database (2010-2020). https://statsmauritius.govmu.org/Pages/Statistics/By_Subject/SDGs/SB_SDG.aspx.

- (25) Government of Mauritius. 2013. Tertiary Education Strategic Plan 2013-2025. https://docplayer.net/11236127-Tertiary-education-strategic-plan-2013-2025.html.

- (26) Statistic Mauritius. 2021. Survey of Employment and Earnings in Large. https://statsmauritius.govmu.org/Pages/Statistics/ESI/Labour/SEE/SEE_Mar21.aspx.

- (27) Human Resources Development Council (HRDC). 2019. Annual Report 2018-2019. https://www.hrdc.mu/index.php/downloads/category/5-annual-reports?download=192:annual-report-2018-2019.

- (28) HRDC. 2019. National Skills Development Strategy (NSDS) 2020-2024. https://www.hrdc.mu/index.php/projects/301-national-skills-development-strategy-nsds-2019-2023.

- (29) HRDC. November 30, 2020. Skills Development Support Scheme for Foreign Direct Investment (SDSS for FDI). https://www.hrdc.mu/index.php/projects/sectoral-projects/326-skills-development-support-scheme-for-foreign-direct-investment-sdss-for-fdi.

- (30) HRDC. About NSDP. https://nsdp.hrdc.mu/index.php/about.

- (31) Republic of Mauritius. November 2020. Statistics in Mauritius, A gender Approach, 2018. https://gender.govmu.org/Documents/2020/Statistics%20in%20Mauritius%20A%20Gender%20Approach%20Year%202018.pdf.

- (32) Republic of Mauritius. 2019. Budget speech 2019-2020, Embracing a brighter future together as a nation. https://www.edbmauritius.org/sites/default/files/2020-09/2019_20budgetspeech.pdf.

- (33) President of the Republic of Mauritius. 2019. The Skills Development Authority Bill, Explanatory Memorandum. https://mauritiusassembly.govmu.org/Documents/Bills/intro/2019/bill2719.pdf.

- (34) President of the Republic of Mauritius. 2009. Mauritius Institute of Training and Development Act 2009. https://www.fakongjian.com/int_doc/laws/20160601/1852/mu018en20160601185206.pdf.

- (35) O. Kuku et al. 2015. Training Funds and the Incidence of Training: The Case of Mauritius. https://ftp.iza.org/dp8775.pdf.

- (36) M. Madhoua et al. STEM Education in the Republic of Mauritius: a Gender Perspective. https://www.repository.mu/mrc/op/op.DownloadFromOutside.php?documentid=876&version=1.

- (37) HEC. 2021. List of Indicative Priority Fields of Study 2021/2023. https://www.hec.mu/pdf_downloads/pub_rep_pdf/LIPFS_2021-2023%20_1102.pdf.

- (38) Ministry of Technology, Communication and Innovation. 2017. Digital Mauritius 2030. https://ncb.govmu.org/ncb/strategicplans/DigitalMauritius2030.pdf.

- (39) Mohamedbhai, Goolam. July 2021. Addressing the challenge of closing the skills gap. https://www.universityworldnews.com/post.php?story=20210707095325999

- (40) World Bank. 2021. Mauritius Country Economic Memorandum: Through the Eye of a Perfect Storm. http://documents.worldbank.org/curated/en/586691621628367648/pdf/Mauritius-Through-the-Eye-of-a-Perfect-Storm-Coming-Back-Stronger-from-the-COVID-Crisis-A-World-Bank-Group-Country-Economic-Memorandum.pdf.

- (41) Youth Employment Programme (YEP). Fields. http://www.yep.mu/fields.php.

- (42) HRDC. 2020. National Training & Reskilling Scheme (NTRS). https://www.hrdc.mu/index.php/news-press/329-economic-recovery-programme-national-training-and-reskilling-scheme-ntrs-1.

- (43) Mauritius News. 2022. The Education and Health Hub of Côte-d’Or welcomes the new MIE campus. https://mauritiushindinews.com/ion-news/the-education-and-health-hub-of-cote-dor-welcomes-the-new-mie-campus/.

- (44) Ministry of Foreign Affairs. 2019. Voluntary National Review Report of Mauritius 2019. https://sustainabledevelopment.un.org/content/documents/23462Mauritius_VNR_Report_2019.pdf.

- (45) UNEP. 2015. Agenda 2063- First Ten Year Plan. https://wedocs.unep.org/bitstream/handle/20.500.11822/20823/Agenda%202063%20-%20FIRST%20TEN%20YEAR%20PLAN%20%20%20September%20%202015.pdf?sequence=1&isAllowed=y.

- (46) University World News Africa Edition. 2021. Mauritius, Addressing the challenge of closing the skills gap. https://www.universityworldnews.com/post.php?story=20210707095325999.

- (47) UNDP stakeholder consultation with a prominent professional skills qualification provider conducted on November 18, 2021.

- (48) Kuku, Oluyemisi; Orazem, Peter F.; Rojid, Sawkut; Vodopivec, MilanEconstor. 2015. Training Funds and the Incidence of Training: The Case of Mauritius. https://www.econstor.eu/bitstream/10419/107560/1/dp8775.pdf.